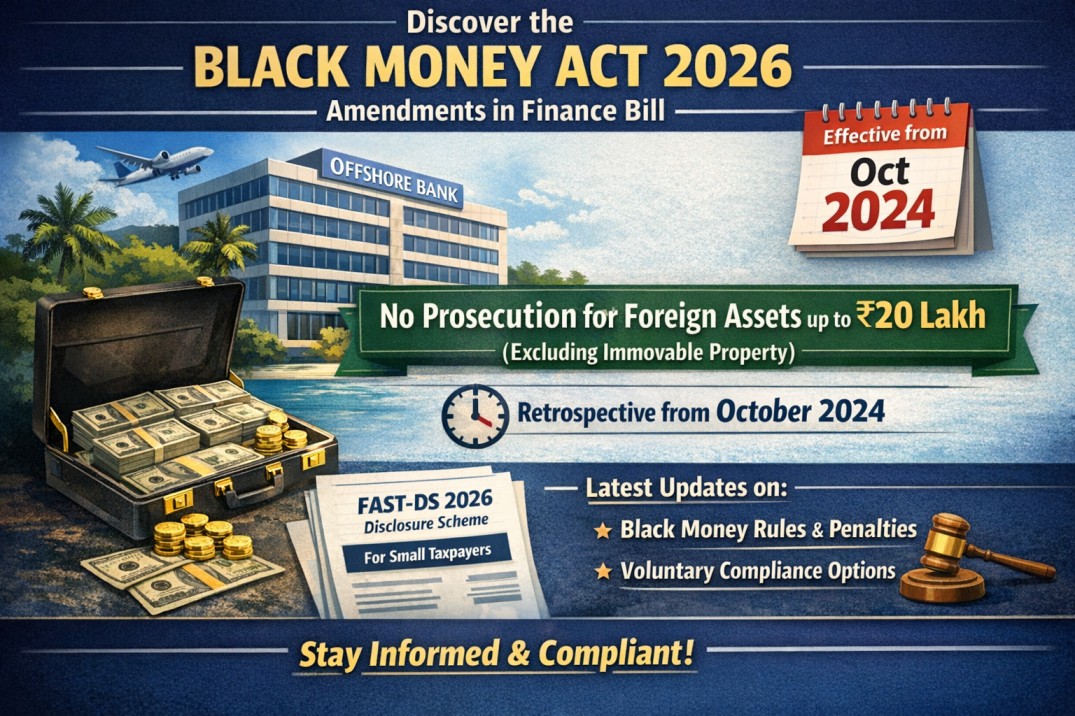

The Central Government of India has introduced key amendments to the Black Money (Undisclosed Foreign Income and Assets) and Imposition of Tax Act, 2015 (commonly known as the Black Money Act) through the Finance Bill 2026. These changes provide significant relief for non-disclosure of small-value foreign assets, removing the threat of imprisonment in certain cases while introducing a voluntary disclosure scheme. This move has ignited debates on whether it genuinely aids small taxpayers or potentially weakens efforts to combat black money stashed abroad.

Government’s Rationale: Protecting Small Taxpayers from Harsh Penalties

The amendments, effective retrospectively from October 1, 2024, amend Sections 49 and 50 of the Black Money Act. Previously, wilful failure to disclose foreign assets or income could lead to rigorous imprisonment of up to 7 years and heavy fines. Now, prosecution provisions do not apply to foreign assets (excluding immovable property such as land or buildings abroad) where the aggregate value does not exceed ₹20 lakh.

The government explains this as a measure to introduce proportionality in enforcement. It aims to avoid unnecessary harassment for minor, often inadvertent, non-disclosures by genuine small taxpayers—such as students studying overseas, young professionals on foreign assignments, or employees with modest foreign bank accounts or investments (e.g., ESOPs from multinational companies). The Income Tax Department has noted that many such cases involve honest oversights rather than deliberate evasion.

This threshold aligns with earlier penalty relaxations under Sections 42 and 43 (via Finance Act amendments), where the ₹10 lakh annual penalty for non-disclosure was already exempted for such low-value movable assets.

Key Feature: Foreign Assets of Small Taxpayers – Disclosure Scheme, 2026 (FAST-DS 2026)

A major highlight of the Finance Bill 2026 is the introduction of the Foreign Assets of Small Taxpayers – Disclosure Scheme, 2026 (FAST-DS 2026). This is a one-time, six-month voluntary compliance window (exact start date to be notified by the Central Government) for resident taxpayers to declare undisclosed foreign income or assets from past years.

Under FAST-DS 2026:

- Eligible undisclosed foreign assets or income up to ₹1 crore (aggregate fair market value) can be declared.

- Declarant pays 30% tax on the undisclosed amount plus an additional 30% levy (in lieu of penalty), with no interest charged.

- Full immunity from prosecution and further penalties under the Black Money Act is granted upon compliance.

- Exclusions apply to cases involving proceeds of crime (under PMLA) or ongoing prosecutions/assessments.

This scheme echoes the 2015 one-time compliance window but is tailored for small taxpayers, making regularization easier and more attractive than facing stringent Black Money Act consequences (which include 30% tax + up to 120% penalty + ₹10 lakh annual fines + possible 7-year jail term).

Criticisms and Opposition: Is This a Softening on Black Money Crackdown?

The changes have sparked controversy. Critics argue that the ₹20 lakh limit is too generous and could serve as “eyewash” to gradually open doors for larger concealments. Opposition voices claim it dilutes the original intent of the Black Money Act, enacted to fulfill promises made during the 2014 elections to repatriate black money from abroad and credit accounts with substantial sums (e.g., the unfulfilled ₹15 lakh per citizen pledge).

Some experts and sections within the Income Tax Department suggest the rule primarily shields deliberate concealers under the guise of helping ordinary people. They fear future limit increases, drawing parallels to relaxations in cash transaction rules (e.g., PAN requirement threshold raised from ₹50,000 to ₹10 lakh in some cases), which allegedly encourage rather than curb black money flows.

Political opponents highlight the irony: After 12 years, instead of bringing back black money, the government appears to ease penalties for holding it abroad. If large-scale evasion had been directly addressed, it might have invited backlash; starting with a “safe” ₹20 lakh cap avoids immediate controversy while potentially paving the way for expansions.

Broader Context and Implications

The Black Money Act, 2015, was a landmark law to tackle illicit foreign wealth, imposing severe deterrents. These 2026 amendments reflect a shift toward compliance facilitation over punitive action for minor cases, aligning with “ease of doing business” and taxpayer-friendly reforms.

For NRIs, returning professionals, or global Indians:

- Forgotten foreign bank accounts or small investments can now be regularized via FAST-DS without jail fears.

- Immovable foreign property remains strictly regulated—no relief there.

Taxpayers should consult professionals to assess eligibility and file declarations promptly once notified.

This development underscores the government’s evolving approach: balancing strict anti-evasion measures with practical relief for genuine small-scale issues. Whether it strengthens voluntary compliance or inadvertently aids evasion remains a point of national debate.